Introduction

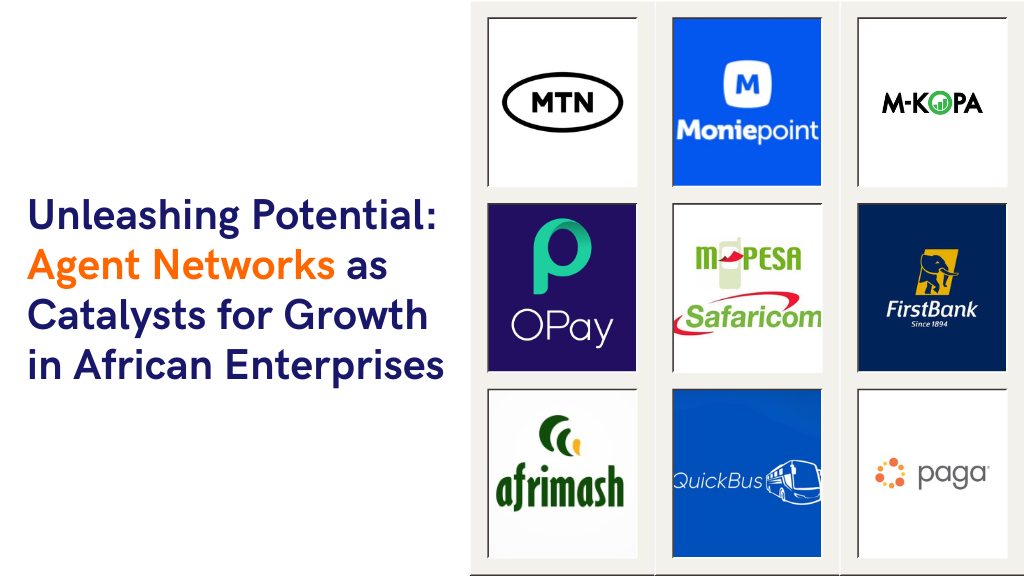

MTN, Opay, Moniepoint, M-Kopa, M-Pesa, Paga, FirstBank, and Access all share a similar catalyst behind their success. Can you guess what it is?

Yes, it is true that they are all highly accomplished companies and all have fintech solutions. But their similarities go way beyond that.

Although they are widely regarded as digital enterprises, their true innovations lie in their ability to blend their digital platform with a physical network that reaches millions of end users through their use of Agent Networks.

These companies have effectively adapted to Africa’s unique digital landscape and extended their services beyond the realm of technology-savvy consumers, an occurrence not commonly observed among digital enterprises in Africa.

Why do agent networks make great tools for scaling in Africa?

Africa is a continent with great potential for economic growth and social development but also faces significant challenges such as poverty, inequality, low financial literacy, and poor infrastructure. One of the ways that African enterprises can overcome these challenges and tap into the opportunities is by leveraging agent networks.

An agent network is a network of individuals or businesses that serve as intermediaries between a service provider and customers in underserved areas (limited internet access or technological capabilities). It establishes physical points of interaction and supply chains to bridge the gap between the service provider’s digital platform and customers in remote or underserved regions..

Agent networks are extensively used in Africa, particularly in the financial sector, which includes banking, insurance, remittances, payments, and savings. They have also been applied in a wide range of industries such as agriculture, telecommunications, health, education, energy, logistics and e-commerce.

These agent network platforms serve different purposes, such as facilitating payments through kiosks and agents, managing stock for smallholder farmers in agriculture, aggregating domestic shipping demand for small businesses in logistics, and providing connectivity through solar-powered internet kiosks that offer local content and services. Additionally, they are involved in telecommunications by serving as SIM registration agents.

Agent networks enable service providers to reach more customers, increase efficiency, and enhance customer loyalty and satisfaction. They also benefit the agents themselves, who earn commissions or fees for their services, and the customers, who enjoy convenience, affordability, security, and quality of service.

Purpose of the Article

The purpose of this article is to provide an overview of agent networks as a growth tool for African enterprises, covering the following aspects

- What are agent networks and what are their key components?

- How do agent networks work and what are the roles and responsibilities of agents?

- What is the history of agent networks in Africa and what are some of the success stories and impact?

- What are the benefits of agent networks for service providers, agents, customers, and society at large?

- What are the future trends and innovations in agent networks and what are the potential challenges and solutions?

- What are the opportunities for collaboration and partnerships among different stakeholders in agent networks?

The article aims to inform and inspire African entrepreneurs, business owners, managers, investors, policymakers, researchers, and anyone interested in learning more about agent networks and how they can be harnessed to create value and impact in Africa.

The History of Agent Networks in Africa

Early Adoption and Evolution

Agent networks gained popularity in Africa in the early 2000s as a solution to the challenges of reaching remote and underserved populations. One of the earliest examples of agent networks was the use of SIM card registration agents by telecommunications companies.

This model was later adopted by the financial services sector. As time passed, agent networks expanded to include sectors such as finance, agriculture, health, education, energy, and e-commerce. Collaboration between governments, development organizations, and private companies led to the development of agent network frameworks to bridge service gaps and stimulate economic growth.

Countries like Kenya, known for its pioneering mobile money service M-Pesa, achieved remarkable success in using agent networks to provide accessible and affordable financial services to previously underserved populations. Other African countries, including Nigeria, Tanzania, Uganda, and Ghana, followed suit by adopting agent network models and experiencing positive outcomes.

Benefits of Agent Networks

Agent networks in Africa have demonstrated substantial success and generated significant impacts, such as

- Financial Inclusion

Agent networks have played a pivotal role in expanding financial access and inclusion. They have enabled millions of previously unbanked individuals to open accounts, make transactions, access credit, save money, and protect against risks, leading to increased economic participation and poverty reduction.

- Job Creation and Entrepreneurship

The growth of agent networks has created numerous employment opportunities, especially in rural and peri-urban areas where formal job opportunities are scarce. Agents often become micro-entrepreneurs, generating income, improving livelihoods, and creating economic value within their communities.

- Improved Service Delivery

Agent networks have enhanced service delivery by bringing services closer to the customers. They have reduced travel distances, waiting times, and administrative hurdles, providing convenience, speed, and accessibility to a wide range of services.

- Increased Efficiency and Cost-effectiveness

By leveraging agent networks, service providers have reduced the costs associated with establishing and maintaining physical branches. The transactional efficiency and lower overhead expenses have translated into improved operational efficiency, allowing service providers to offer more affordable services and reach previously untapped markets.

How do Agent Networks Work?

Structure and Operation of Agent Networks

Agent networks operate through a structured framework where agents are authorised to provide specific services on behalf of the service provider. The service provider establishes a contractual agreement with the agents, outlining their roles, responsibilities, targets and commission.

Agents are equipped with the necessary technology infrastructure and are trained in service delivery, customer management, and operational procedures. They receive ongoing support and supervision from the service provider to ensure adherence to quality standards and compliance with regulatory requirements.

Customers visit agents’ locations to access the services they require. Agents facilitate transactions, handle documentation, collect payments, and provide necessary customer assistance. Depending on the complexity of the service, agents may process transactions electronically or through paper-based systems. The transactions conducted by agents are usually recorded and transmitted to the service provider for further processing and record-keeping.

Key Components of Agent Networks

Agent networks comprise several essential components that work together to facilitate the delivery of services. These components include

Service Providers

These are the entities that offer services and products through the agent network. They can be financial institutions, telecom companies, utility providers, e-commerce platforms, government agencies, or any organization that aims to reach customers efficiently and affordably.

Agents

Agents are independent individuals or businesses that are authorized by the service providers to deliver services to customers on their behalf. They can be small shop owners, entrepreneurs, community leaders, or existing retail networks. Agents act as the face of the service provider and are responsible for customer interaction and service delivery.

Customers:

Customers are the end-users who access services through the agent network. They can be individuals, households, businesses, or organizations seeking various services such as banking, insurance, payments, remittances, or other relevant offerings.

Technology Infrastructure

Agent networks rely on technology infrastructure to enable seamless communication and transactions between service providers, agents, and customers. This infrastructure typically includes mobile devices, point-of-sale (POS) terminals, biometric devices, internet connectivity, and backend systems for data processing and management.

Regulatory Framework

The operation of agent networks is governed by regulatory frameworks set by the relevant authorities. These frameworks define the rules and requirements for agents and service providers, ensuring compliance, consumer protection, and the stability and integrity of the financial system

Industries Served by Agent Networks

While agent networks initially gained prominence in the financial sector, their applicability has expanded to various industries, including

Financial Services

Agent networks have revolutionised banking, remittances, payments, and microfinance by extending financial services to unbanked populations. They have facilitated secure and affordable transactions, money transfers, and access to credit, promoting a savings culture and enabling economic empowerment. (Opay, Moniepoint)

Agriculture

Agent networks have been utilised to provide farmers with access to inputs (Afrimash), information, credit, and markets. They enable agricultural value chain actors to connect with suppliers, buyers, and financial institutions, fostering productivity, profitability, and sustainable growth in the agricultural sector (ThriveAgric).

Telecommunications

Agent networks have been crucial to the expansion and success of the telecommunications sector, particularly in underdeveloped or remote regions with a dispersed consumer base. Telecommunication companies often utilise agent networks, operating through small kiosks, shops, or roadside stalls, to sell airtime and data packages, especially in rural areas. These agents also handle SIM card registrations, equipped with the necessary devices to capture customer details and, where required, biometrics, in accordance with regional regulatory requirements. Additionally, these agents serve as the physical sales force for telecom companies, selling devices such as mobile phones, and related accessories.

Energy

Agent networks have facilitated the distribution of clean energy solutions, such as solar lamps and clean cooking stoves, in off-grid areas. They have expanded access to affordable and sustainable energy sources, contributing to environmental conservation and socioeconomic development. (M-Kopa).

Logistics

Agent networks have been effectively utilized in the logistics industry to streamline operations, improve accessibility, and broaden the customer base, particularly in regions with underdeveloped infrastructures or in rural or remote areas. Let’s take QuickBus as an example, which uses agent networks for ticket sales. Agents located in kiosks, shops, or other accessible points in the city or at bus stops sell tickets to customers, making it convenient for those without access to online booking options.

Roles and Responsibilities of Agents

Agents play a crucial role in the functioning of agent networks. Their responsibilities typically include

Customer Onboarding

Agents assist customers in the registration and enrollment process, ensuring they meet the necessary requirements and documentation.

Service Delivery

Agents facilitate various transactions and services requested by customers, such as order processing, cash deposits and withdrawals, fund transfers, bill payments, account inquiries, insurance policy issuance, loan disbursements, and more.

Customer Support

Agents provide customer assistance, address queries, resolve complaints, and offer guidance on service usage, educating customers about the benefits and features of the services provided.

Reporting and Compliance

Agents maintain accurate records of transactions, perform reconciliations, and comply with reporting requirements as stipulated by the service provider and regulatory authorities.

Technology and Infrastructure Requirements

Agent networks rely heavily on technology and infrastructure to ensure efficient and secure service delivery. Some key technology and infrastructure requirements include

- Mobile Devices:

Agents typically use smartphones or feature phones equipped with specialised applications to access the service provider’s system, process transactions, and communicate with customers.

- Point-of-Sale (POS) Terminals:

Agents may use POS terminals to accept card payments and perform electronic transactions.

- Biometric Devices:

In some cases, agents may use biometric devices to verify customer identities, ensuring secure and reliable transactions.

- Internet Connectivity:

Stable internet connectivity is crucial for agents to access the service provider’s system, transmit transaction data, and receive real-time updates.

- Backend Systems Service:

Providers maintain robust backend systems to process and manage agent transactions, customer data, and generate reports. These systems support seamless integration with agents’ devices and ensure the accuracy and security of transactions.

The Future of Agent Networks in Africa

Emerging Trends and Innovations

The future of agent networks in Africa holds exciting possibilities as technology continues to evolve and new innovations emerge. Some of the emerging trends and innovations include

- Digital Transformation

Agent networks are increasingly leveraging digital technologies, such as mobile apps, digital wallets, and online platforms, to enhance service delivery, streamline processes, and expand service offerings. This digital transformation is expected to further improve efficiency, accessibility, and scalability.

- Data Analytics and Artificial Intelligence

The utilization of data-driven decision-making and artificial intelligence can enable service providers to gain valuable insights into customer behaviour, market trends, and risk profiles. This information can be leveraged to develop tailored products, improve customer experience, and enhance decision-making.

- Integration with E-commerce

Agent networks can integrate with e-commerce platforms, allowing customers to access a wide range of products and services beyond traditional financial offerings. This integration opens up opportunities for cross-selling, expanding revenue streams, and stimulating digital commerce in underserved areas.

Potential Challenges and Solutions

While agent networks offer tremendous potential, they also face certain challenges that need to be addressed for sustained growth and impact. Some of these challenges include

- Agent Training and Support:

Agents require adequate training and ongoing support to effectively deliver services, handle customer inquiries, and address technical issues. Comprehensive training programs, robust support mechanisms, and regular monitoring can empower agents and enhance their performance.

- Regulatory Frameworks:

Regulatory frameworks need to be responsive, flexible, and supportive of agent network operations. Governments and regulators should establish clear guidelines, facilitate innovation, and strike a balance between consumer protection, financial stability, and market development.

- Cybersecurity and Fraud Mitigation:

As agent networks rely on digital technology, there is a need to strengthen cybersecurity measures and mitigate fraud risks. Collaborative efforts between service providers, agents, and technology providers can help implement robust security protocols, ensure data protection, and raise awareness among agents and customers.

- Agent Loyalty:

In many scenarios, agents may be affiliated with multiple service providers, especially in sectors like financial services or telecommunications. While this diversification may increase their earnings, it could lead to divided loyalty. As a result, they may not promote one service over another or may even favour the service that offers them the highest commission, which might not necessarily align with the strategic interests of each service provider they represent.

Opportunities for Collaboration and Partnerships

The future of agent networks in Africa presents opportunities for collaboration and partnerships among various stakeholders. Some potential collaboration opportunities include

- Public-Private Partnerships:

Governments, financial institutions, and development organizations can collaborate to establish and support agent network initiatives. Public-private partnerships can combine resources, expertise, and networks to accelerate the growth and impact of agent networks in underserved areas.

- Technology Providers and Service Integrators:

Collaboration between technology providers, service integrators, and service providers can drive innovation, develop customized solutions, and ensure seamless integration of agent network infrastructure with backend systems.

- Knowledge Sharing and Capacity Building:

Industry associations, research institutions, and development organizations can facilitate knowledge sharing, conduct research, and provide capacity-building programs to enhance the understanding and effectiveness of agent networks.

- Cross-Sector Collaboration:

Collaboration among different sectors, such as financial services, agriculture, healthcare, and education, can lead to innovative models that combine multiple services and address the holistic needs of underserved populations.

TLDR

Agent networks have emerged as a powerful growth tool for African enterprises, offering a range of benefits including improved access to financial services, employment and entrepreneurship opportunities, enhanced customer experience, and financial inclusion. These networks have demonstrated significant success across various sectors and have the potential to drive economic growth and social development in Africa.

To harness the full potential of agent networks, stakeholders must continue to embrace technology, innovate, and collaborate. Governments, service providers, agents, technology providers, and development organizations need to work together to address challenges, seize emerging opportunities, and create an enabling environment that supports the growth and sustainability of agent networks. By doing so, African enterprises can unlock new markets, reach untapped populations, and contribute to inclusive and sustainable development across the continent.